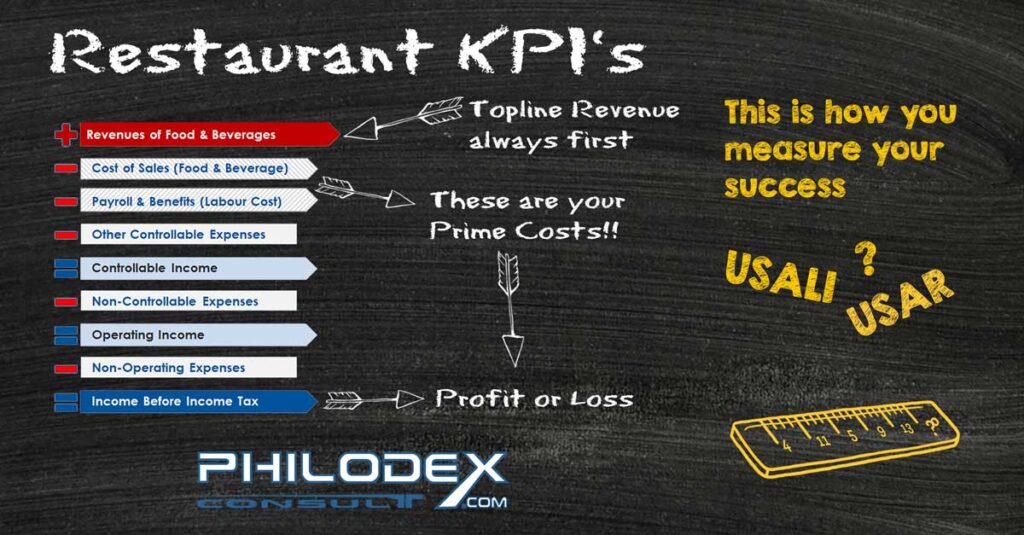

Key Performance Indicators for Restaurants

The best way to measure the performance of a gastronomic business is to look at the KPI’s according to USAR –

USAR stands for “Uniform System of Accounts for Restaurants”

A restaurant income statement, using USAR, shows sales and cost of sales related to food and beverage and any other expenses related to the functioning of the restaurant.

Let me explain how you compile such a statement.

List the total Revenue (Sales) before expenses always on the top line and that is called the TOPLINE REVENUE = TTL Sales before expenses.

Different Operations may report revenue in different ways. It can be divided by just food and beverages. Other ways of reporting revenues would be

- Meat, fish, wine, beer, non-alcoholic drinks, coffee, …

- Breakfast, lunch, dinner, …

- Starter, main, dessert, …

- By outlet e.g. restaurant, bar, café, roomservice, take away, …

- Per outlet and category – outlet/food, outlet/beverages, …

It is entirely up to the management or to you AS LONG AS IT IS CONSISTENT – which ever approach you want to use is fine. And as long as revenue is listed first and you have a sub total for topline revenue.

+ Top Line Revenue

Then we will always have Prime Costs under the USAR format

– Prime Costs – which are Total Costs of Sales + Total Labour Expenses

– Controllable Expenses

= Controllable Income

– Non Controllable Expenses

= Operation Income

– Non Operation Expenses

= Income before Tax

REVENUE

All the sales divided in the way that you have decided, listed by categories.

COST OF SALES

the amount paid for goods and F&B products used to create revenue. In order to sell food and beverages you need to purchase food and beverages, and that is one of your biggest costs.

These are called Prime Costs

The reason why it is called prime cost is because they represent a very big portions of your expenses that you have to take away from those revenues.

In additon, you have control over these costs. And what I mean by these – if you take control of your F&B Costs you can watch for

- any kind of inefficiency

- make sure there is not too much waste

- make sure your plates, the size of the portions you serve are consistent

You will have to manage these costs because they have a huge impact on your results.

MENU ITEM – Engineering

How to control your beverage cost in depth – item by item?

When you know how much of each item has been sold in a given time frame, and how much profit is driven by each menu item, you can identify the popularity and profitability.

That is where a Menu Engineering Spreadsheet comes in handy. Prepared with a few – not very complicated formulas – and after your database input it will categorize your items and indicate to which of the following categories each menu item belong:

-

-

- Star

- Question Mark

- Horses

- Dog

-

Register for my Newsletter in order to learn more about MENU ITEM Engineering in one of my next Newsletters.

LABOUR (Payroll) COST

These are also Prime Costs.

Again – The reason why it is called prime cost is because they represent a very big portions of your expenses that you have to take away from those revenues. And you also have to have control over these – same as the Cost of Sale.

Total labour cost includes

Staff, management, benefits, insurance, pension scheme, salaries, wages, service charges, contracted labour and bonuses

And if you take control of your Labour Cost – you can look out for:

- If it is not too busy you can cut some staff and save money on your part time staff or contracted labour cost

- So you have control over this cost and it is in your best interest to keep an eye on these costs.

You always want to make sure to watch your Prime Cost

You will have to manage these costs because they have a huge impact on your results.

OTHER EXPENSES

Controllable Expenses – Other costs that can be controlled by the business and what your Managers have control over.

- Entertainment – Once you book someone you paying a specific price. But you can decide how much you want to spend for Entertainment.

- Marketing – Or how much money you want to spend on Marketing.

- Utilities – Depents on how much you using whether you shut down everthing during the night. That way you can control a bit more.

- Administration and General – You can control by organising and time management.

- Repairs and Maintenance – Control that as much as possible. Staff training for equipment handling, write manuals for machinery.

On the Controllable Income Line it would give you a subtotal of your Controllable Income. (Revenue – Prime Cost – Controllable Expenses)

Up to here there you have some control over the costs and expenses. So make sure you control this to the best of your ability and as efficiently as possible to make sure that you make the most controllable income as you possible can.

Non-Controllable Expenses – These are expenses that do not fluctuate with the amount of sales.

There are fixed expenses, that means no matter whether you sell zero or a million, it does not matter, you will always have to pay for your occupancy cost. They will stay the same and you will have no control over these expenses:

- Rent, real estate taxes, personal property taxes, insurance on building and contents, depreciation, and amortization expenses

- Irregular costs that do not correspond with sales deviations

UNIFORM SYSTEM OF ACCOUNTS FOR RESTAURANTS

Summary

Here is a review of our KPI’s – your Key Performance Indicators

- Always Revenue first

- Minus your Cost of Sales

- Minus your Payroll and Benefits – your Labour Costs which are together called your Prime Costs

- You then take away your Controllable Expenses to find out your Controllable Income

- And then from your Controllable Income deduct your Non Controllable Expenses – things you have no control over to find out your Operating Income

- Minus your Non-Operating Expenses like your rent – anything you do not need to operate but – you still have to account for it

- That way you will find your Income before Income Tax

This will be your Profit or Loss at that point.

Rate me (Google Rezension)

Our F&B Consulting service is here for you at any time!

Questions? Doubts? How does that work?

|